Conquering Tax Season: Navigating Small Business Billing Challenges

For many small business owners, tax season can be one of the most challenging times of the year. It's a period that requires navigating a labyrinth of tax laws and managing the intricacies of business billing. Both can seem like insurmountable tasks, especially for business owners who lack experience in taxation and finance. Yet, with comprehensive planning, the use of efficient tools, and a thorough understanding of tax regulations, these obstacles can be overcome, and the tax season can be mastered with relative ease.

Deep Diving into Business Taxation: Understanding the Basics

The journey towards a successful tax season starts with grasping the fundamental concepts of business taxation. This requires an appreciation of the specific tax obligations that correspond to the type of business you operate, a keen awareness of the timelines associated with tax filing, and the ability to identify potential deductions that can be claimed to reduce your overall tax liability.

Understanding the principles of business taxation provides you with a roadmap that can guide your business through the complexities of tax laws and regulations. Having this knowledge not only assists in ensuring that you're compliant with tax laws, but it can also help you take advantage of various tax breaks that can significantly reduce your tax burden.

The Essential Role of Accurate Record-Keeping

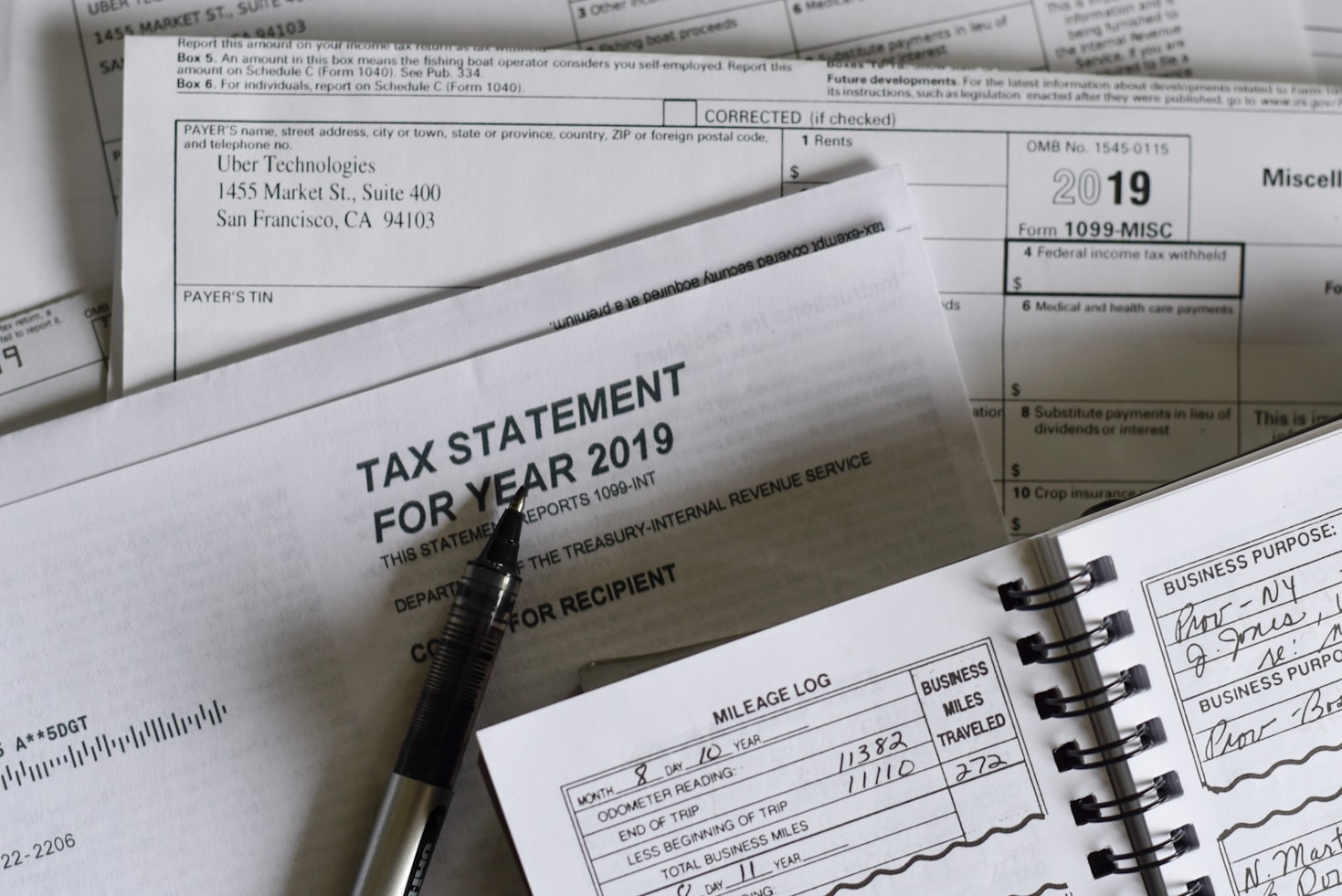

Inadequate or inaccurate record-keeping is a common pitfall many small businesses face during tax season. Such lapses can result in a multitude of issues, such as miscalculations of income or expenses, overlooked deductions, and potential penalties imposed by tax authorities. This can escalate the stress associated with tax filing and potentially increase your tax liability.

To combat these challenges, it's crucial to maintain accurate and comprehensive records of all your business transactions. This includes every invoice issued, every payment received, and every tax-deductible expense incurred. Ensuring meticulous record-keeping and data accuracy not only simplifies the tax filing process but also optimizes your tax position.

Maximizing Efficiency with Billing and Accounting Software

In our increasingly digital world, technology can serve as a vital ally during tax season. Today's advanced billing and accounting software provides an array of features designed to streamline and automate your business's financial management.

These tools offer a range of functionalities that can take much of the burden out of preparing your tax returns. They can track invoices, calculate tax liabilities, and generate detailed financial reports at the click of a button. By reducing the amount of manual labor involved and minimizing the risk of human error, billing and accounting software can transform tax season from a source of stress into a manageable task.

Ensuring a Clear Demarcation between Business and Personal Finances

A frequent mistake made by small business owners is blending their personal and business finances. This intermingling not only complicates your tax calculations but could potentially lead to legal issues with the Internal Revenue Service (IRS). It's crucial to avoid this by keeping separate accounts for your business and personal finances, thereby ensuring a clear demarcation between the two.

By creating this separation, you can also improve your ability to track and manage your business finances. This, in turn, makes it easier to prepare and file your business tax returns, and may also enhance your ability to identify potential tax deductions.

The Value of Professional Assistance: Enlisting the Help of Tax Experts

Taxes are complex, and the laws regulating them are often convoluted and challenging to understand. If you find the process too overwhelming, it's prudent to seek assistance from a professional accountant or tax consultant. These professionals have the knowledge and experience necessary to navigate the complexities of the tax landscape.

They can provide comprehensive guidance throughout the process, ensure you're in full compliance with tax laws, and help you leverage applicable tax breaks. Investing in their expertise can save you a significant amount of time and effort, and potentially reduce your overall tax burden.

Strategic Financial Planning: Preparing for Tax Payments

One of the most effective strategies for managing tax season is to plan ahead for your tax payments. This involves regularly setting aside a portion of your business income to cover future tax liabilities. Not only does this approach help prevent a financial crunch when tax deadlines roll around, but it also allows for better financial management throughout the year.

By incorporating tax planning into your overall business strategy, you can better manage cash flow, prepare for future expenses, and potentially improve the financial health of your business. Ultimately, taking a strategic approach to tax season can help ensure that it becomes a manageable task rather than a source of stress and uncertainty.

FAQ

1. What common mistakes should small businesses avoid during tax season? Common mistakes include not keeping accurate records, mixing personal and business finances, missing deadlines, and not understanding their tax obligations.

2. How does billing software help during tax season? Billing software can automate the tracking of your revenue and expenses, calculate taxes, and generate reports. This simplifies tax preparation and ensures accurate tax filing.

3. Why is it essential to separate business and personal finances? Mixing business and personal finances can lead to complications during tax preparation. It may also cause issues with the IRS if personal expenses are claimed as business deductions.

4. What is the benefit of hiring a professional accountant or tax consultant? Professional accountants and tax consultants understand the complexities of business taxes. They can ensure your business meets all its tax obligations, help identify tax breaks, and offer advice to optimize your tax situation.

Navigating the challenges of tax season and small business billing doesn't have to be a daunting task. With a clear understanding of your tax obligations, accurate record keeping, the right tools, and professional help if needed, you can conquer tax season with ease and focus on what you do best: running your business.